Future of Robotics

Automating physical-world industries will require taking different paths and building important missing pieces.

Everything that moves in the future will be robotic

Two decades since the shift from on-prem to the cloud began, the next revolution is hidden in plain sight: the gradual and eventual full automation of human-in-the-loop processes by robotic systems.

We’ve heard about robotics “venture moments” before, but the catalysts are in place this time:

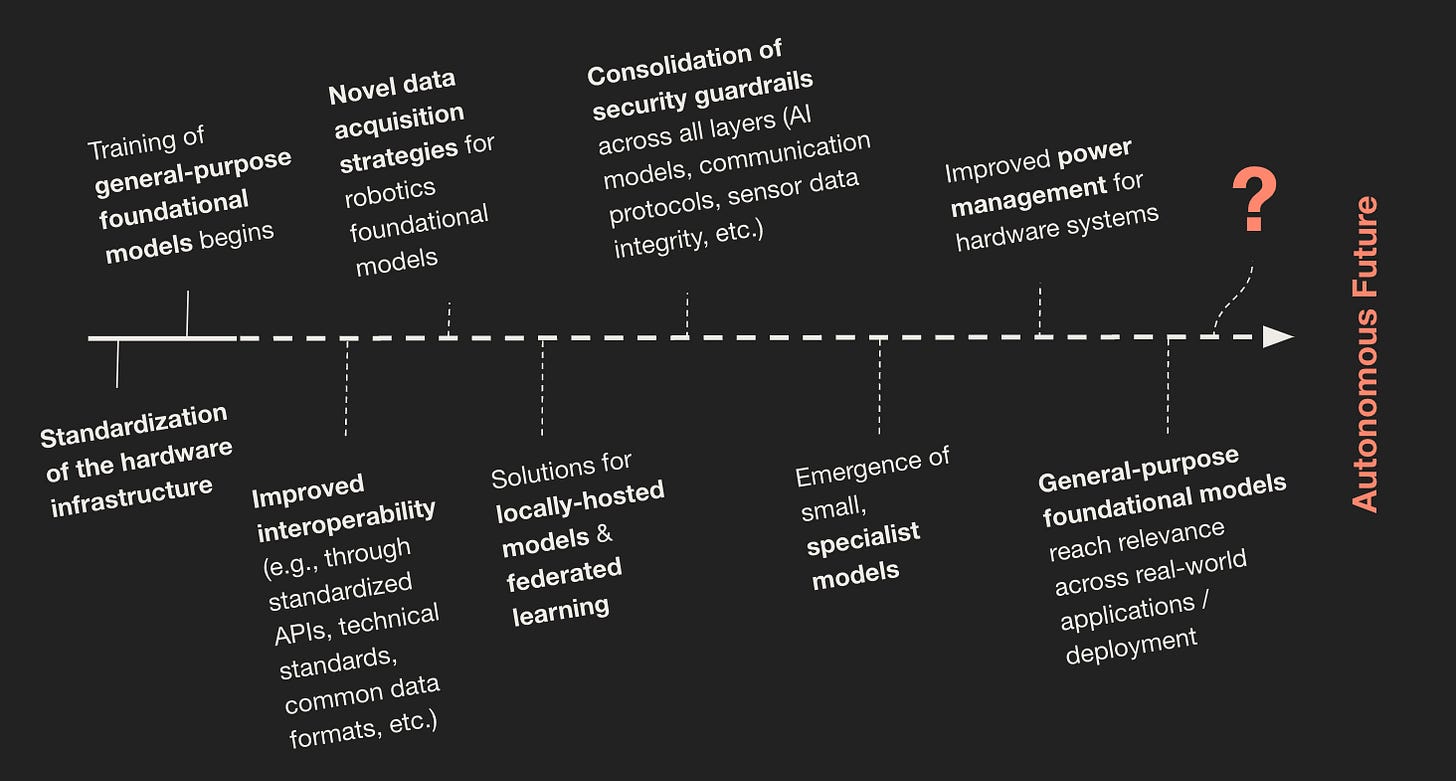

Standardized hardware infrastructure, with increasingly cheap and easily accessible components,

Labor cost arbitrages across industries, and reinforced by widespread labor shortages,

Emerging robotics foundational models that promise to make fully autonomous systems closer than ever (e.g., DeepMind’s RT-2, Nvidia’s GR00T, Physical Intelligence, Skild AI).

No physical-world industry will be left behind

But not every robotics opportunity is a venture opportunity

Daydreaming about artistic projects is a trap for investors and founders. Gorgeous engineering and fantastic sci-fi alone won’t call for venture dollars.

Humanoid projects are the paradigmatic example: expensive, great looking, and not very useful.

They are not the right form factor for most production tasks.

There is no existing corpus of data to train humanoids (unlike language models).

Truth is, less shiny automation feats that can reliably deliver quick ROI on much less dollars, start deploying their systems early on, and then keep iterating towards full automation are a much better bet for founders and investors.

The sweet spot for early-stage robotics and hardware investing:

A novel technical hypothesis that matters if proven true.

The less time and money it takes to prove the hypothesis, the better.

How do founders know if the hypothesis matters? A good proxy is whether they will be able to leverage efficiency gains to reinvest from their own balance sheets.

Evidence of a large untapped automation potential. There must be clear evidence that a lot of value is left on the table.

World-class

roboticistsfundraisers. Technical skills are obviously crucial when building a hardware company, but an ability to effectively navigate capital markets is a real must-have. Without nearterm commercial milestones, it takes tons of cash to develop and deploy robotic systems. Fundraising is challenging as these companies rarely have metrics investors can benchmark against.

Automating physical-world industries will require taking different paths

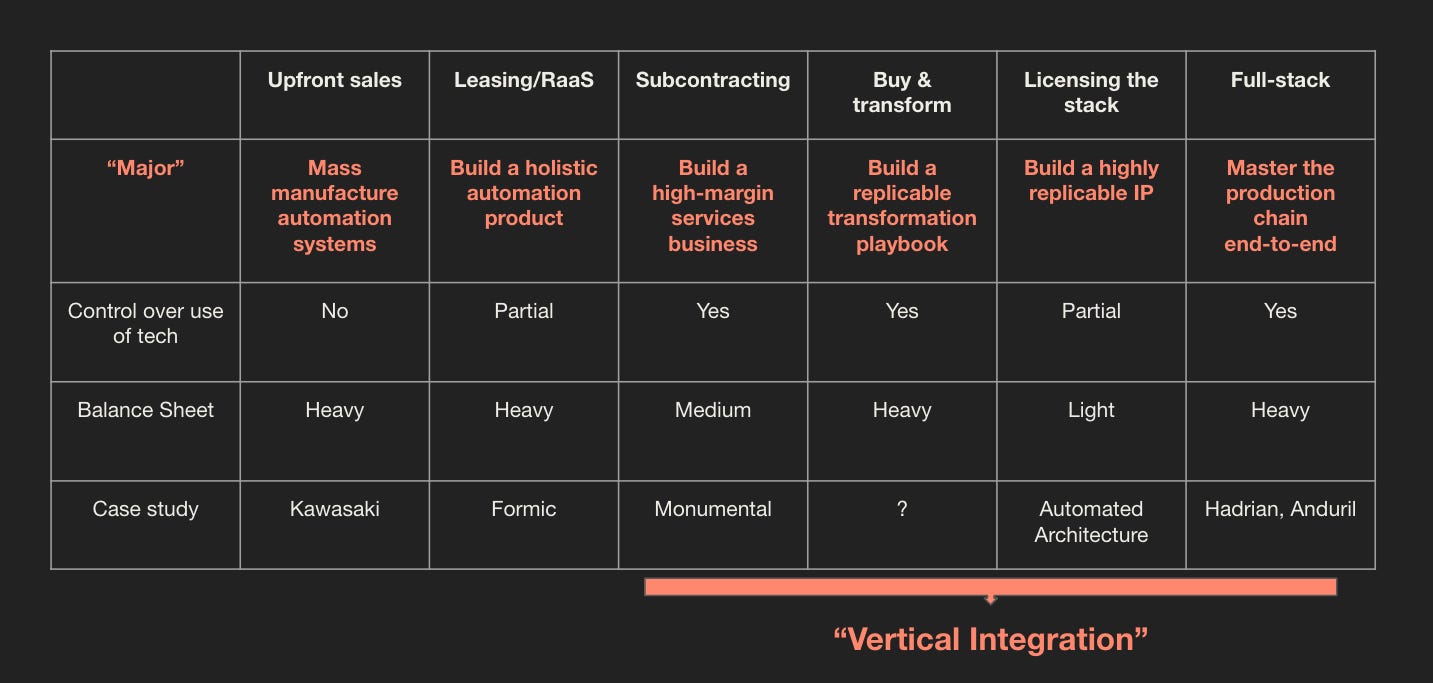

Upfront sales and RaaS/leasing are the two most well-known paths to deploy automation systems.

More recently, vertical integration started to gain momentum in industries where adoption for these systems is hard to get off the ground.

But vertical integration itself hides different approaches that are more or less relevant based on industry-specific context. This gets better explained with a decision tree.

Breaking down the different paths

Founders want to work backward too

The decision tree is not meant to give definitive answers. Rather, it serves as a mental framework to consider alternative (and often overlooked) routes.

In pure game theory fashion, founders want to work backward too by considering all possibilities and evaluate their potential payouts. Some questions worth thinking about include:

How big can each outcome become? And how large will the value capture be for me?

Can I fundamentally transform my industry by picking that route?

What’s the fastest and most cost-effective path to industry transformation?

How expensive will each path be?

How many dollars do I need to spend before unlocking a clear path to positive ROI?

Ultimately, there’s always the possibility that several options remain, forcing founders to iterate and course correct (e.g., Hadrian who followed the “buy and transform” route before choosing to go full-stack).

(Why does it matter?) Founders who successfully deploy hardware will earn the right to do what would be impossible otherwise

Conceptually, they’ll be able to reach the next frontier of progress.

Yes, this will be more capital intensive than deploying software; but in many legacy, physical-world industries, software isn’t the main lever on progress anymore.

The implicit bet is that founders will get rewarded on the scale of the transformation they bring.

Pragmatically, they’ll be buying a call option on a product portfolio that is much harder to build without a stronghold on the underlying hardware, such as:

Management software (e.g. AutoStore, Flexport, Anduril),

Foundational model (e.g. Covariant),

Asset traceability (e.g. Samsara) and predictive maintenance (e.g. Augury).

Roadmap: building the missing pieces for an autonomous future

The future we’re heading towards is crystal clear: Everything that moves in the future will be robotic; but several pieces need to fall into place before we eventually get there.

Why you think this is wrong

Hardware is getting commoditized, investors should stay away

Hardware standardization is a good thing, not a problem. Founders can now deploy automation systems without worrying too much about supply bottlenecks or high costs.

Hardware is just the tip of the iceberg when it comes to what most robotics companies do. The orchestration happening underneath this hardware is what’s truly valuable and proprietary.

Value is going to accrue to foundational models and/or the software stack

Like their LLM counterparts, it’s still unclear how general-purpose robotics foundational models will monetize and not get commoditized in the long-run; and realistically, the time before a “robot brain” gets built is still very far off. On the other hand, small, specialist models are a much more exciting bet for early-stage founders and investors; these models will provide clearer and quicker ROI while being much more efficient in terms of computational efficiency.

As for the software stack, it’s likely to become the second building block besides hardware that will power the infinite tail of automation applications. Founders who will leverage both to transform the economics of legacy physical-world industries will be best positioned to maximize value capture.

There are no good comps for hardware and robotics companies

Yes and no.

Yes, because precedents and IPO exits are limited, and most investors who partner with robotics/hardware founders acknowledge an implicit bet: that both will get rewarded on the scale of the transformation these founders bring.

No, because among the rare precedents we have at our disposal, there are companies across the private/public spectrum that have already been able to commend high multiples despite their focus on deploying hardware (see AutoStore, Tesla, or Anduril, for instance).

If you’ve been thinking about vertical integration and robotics, please reach out at angele@slow.co.